Take a Shortcut to

Your Success

Implement processes, apply methodologies, analyze data, deliver killer presentations and much more with the most complete business toolbox on the market with 150+ ready-to-use spreadsheets, 80+ professionaly designed presentations for less than your netflix subscription

Accounting & Finance

Human Resources

KPIs & Dashboard

Marketing & Sales

Operations & Logistics

Personal

Project Management

Quality

Strategy & Planning

Support

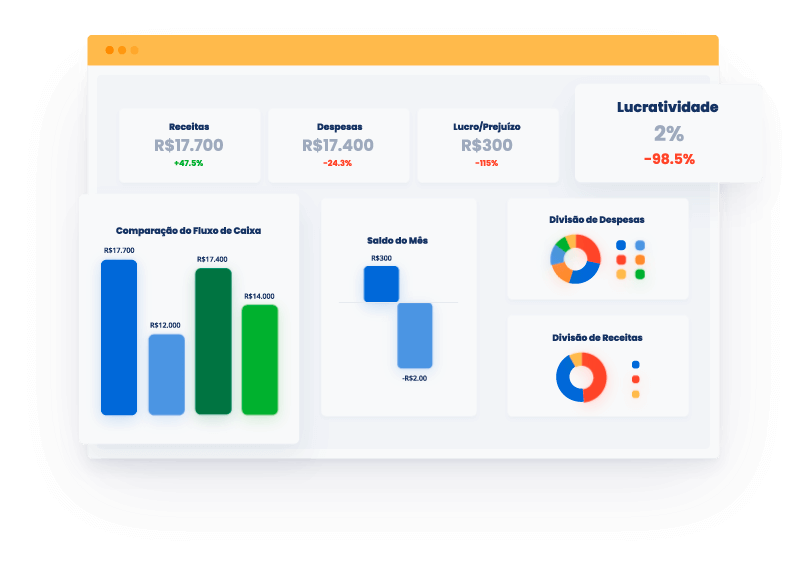

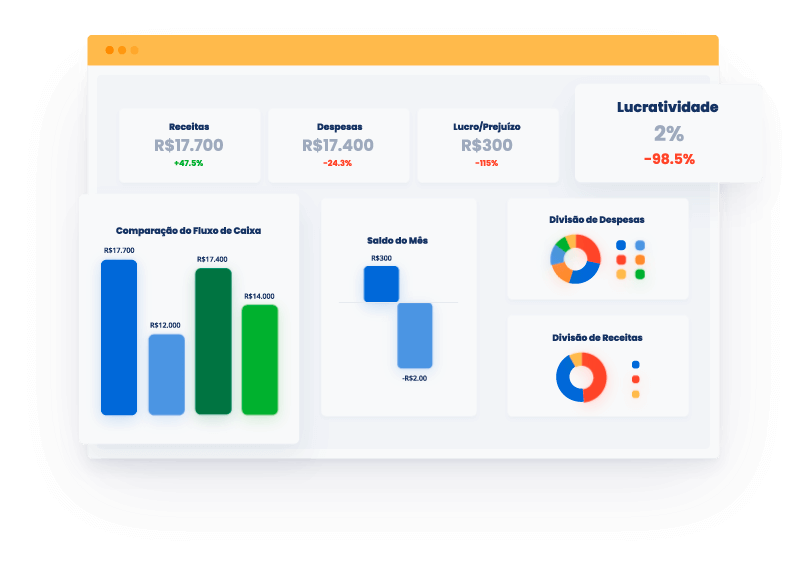

Accounting & Finance

Accounting & Finance

Income, Expenses, and Profitability. Create Cash Flows, Income Statements, and Much More. Complete Financial Management Toolbox!

Human Resources

Human Resources

Manage teams and personnel departments of a company without needing complex systems.

KPIs & Dashboard

KPIs & Dashboard

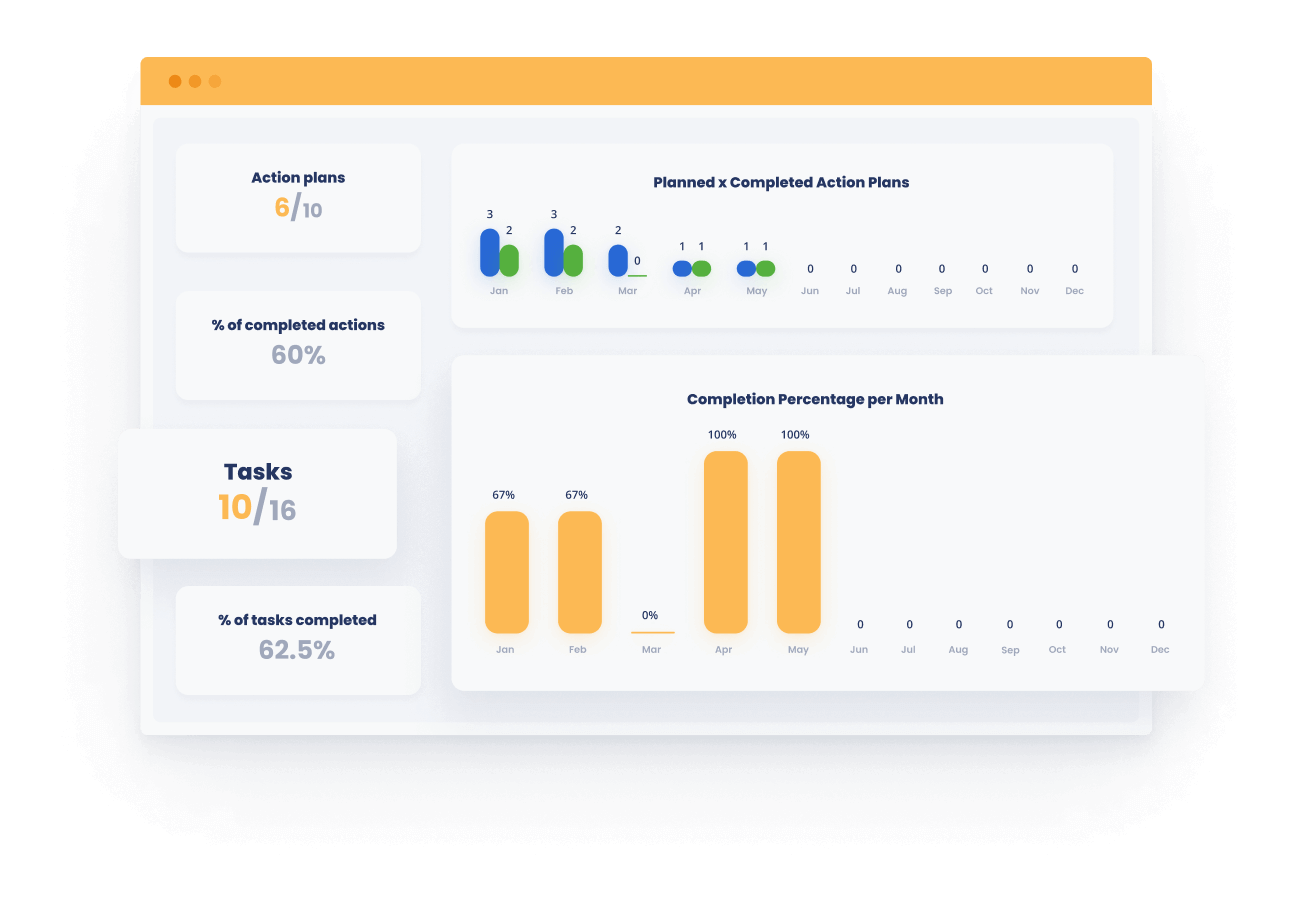

Measure, control, and make better decisions with dashboards.

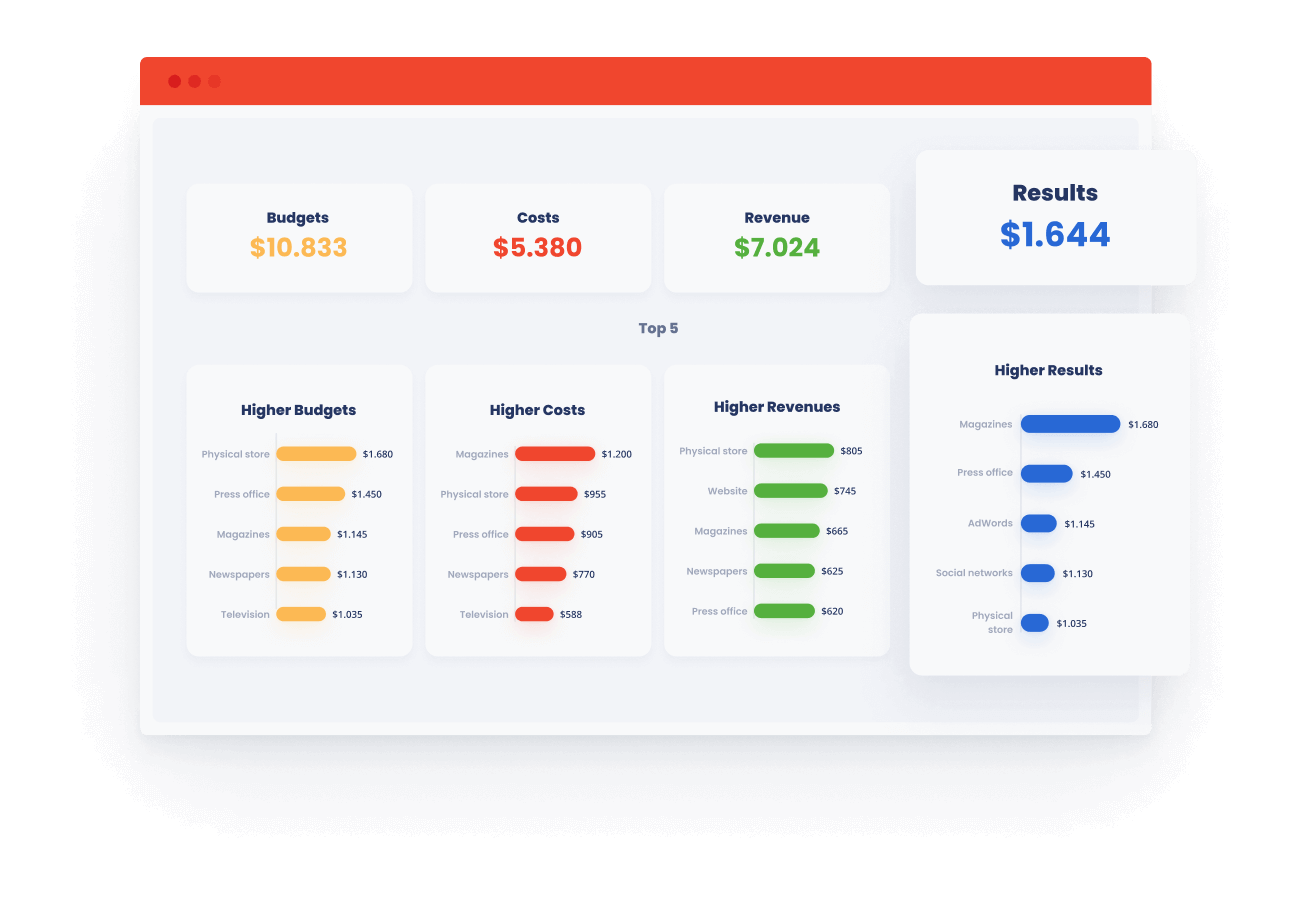

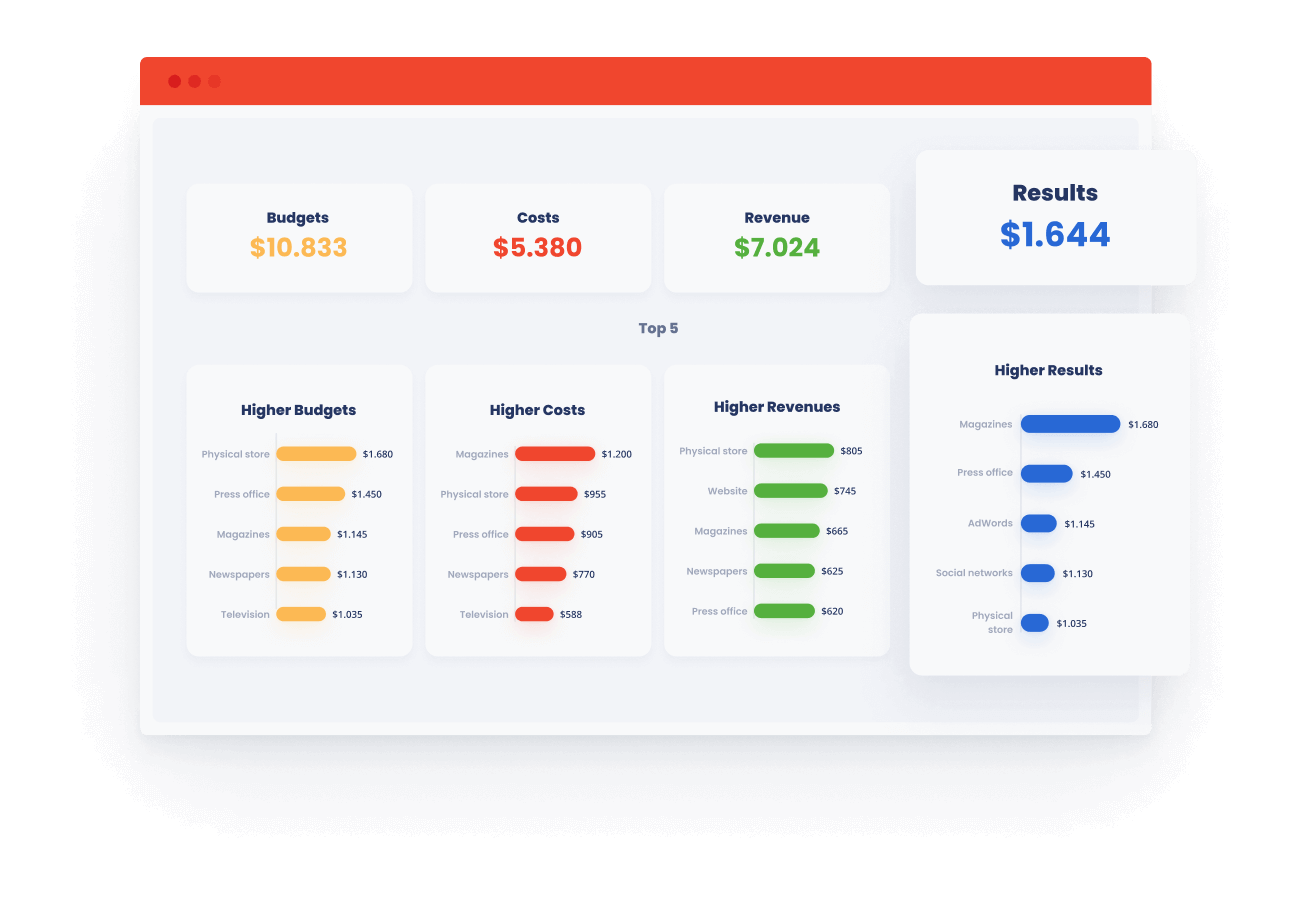

Marketing & Sales

Marketing & Sales

Everything you need to optimize your sales through marketing and planning initiatives or by optimizing your sales funnel and your negotiations.

Operations & Logistics

Operations & Logistics

Optimize your operations through metrics and performance indicators.

Personal

Personal

Optimize, evolve and take control of your life and your family. Manage tasks, groceries, and your finances.

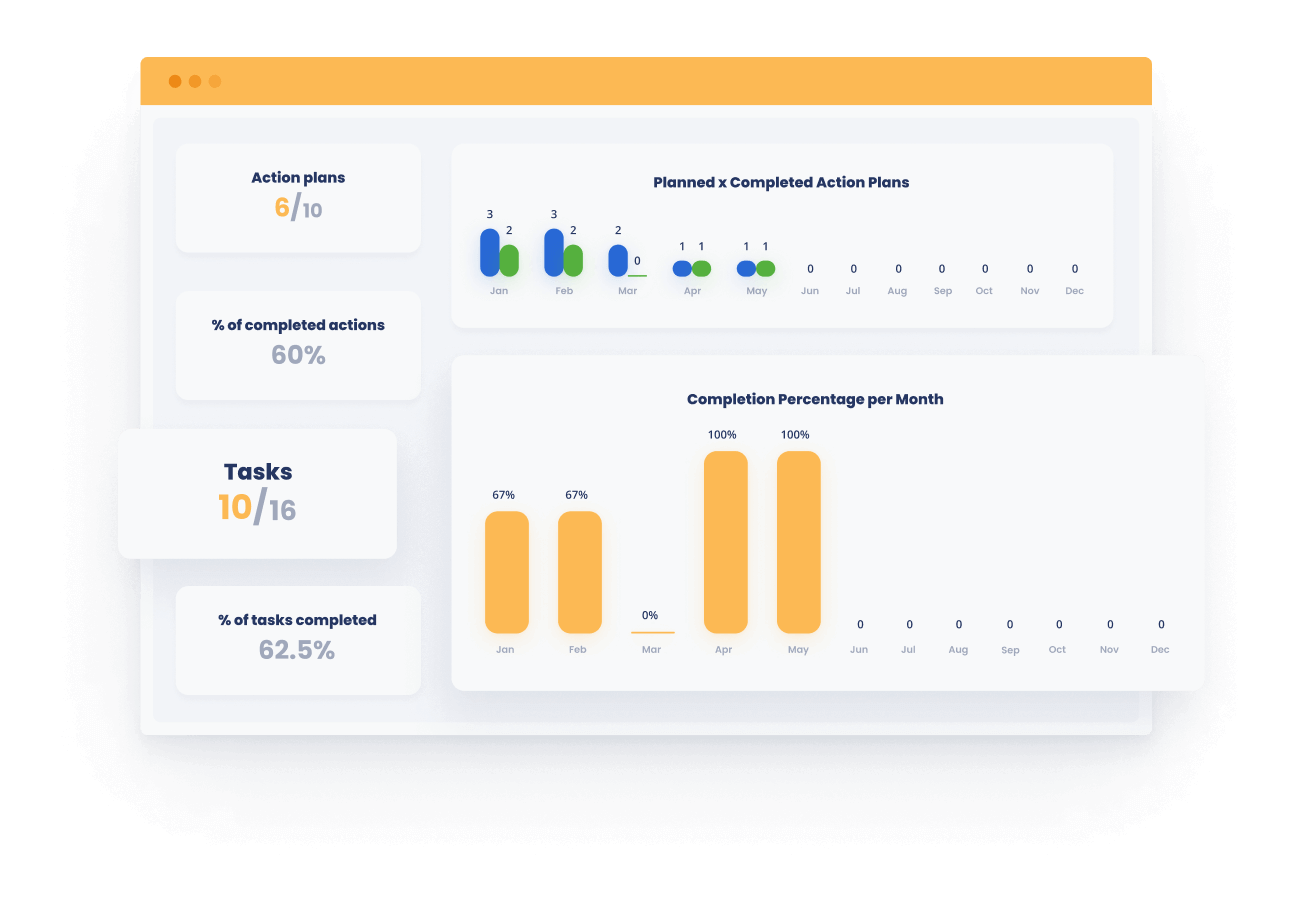

Project Management

Project Management

Define scope, tasks, costs, and control project deliverables with the best project management spreadsheets on the market.

Quality

Quality

If you work with quality or process management, our templates will help you implement the main methods of this business area

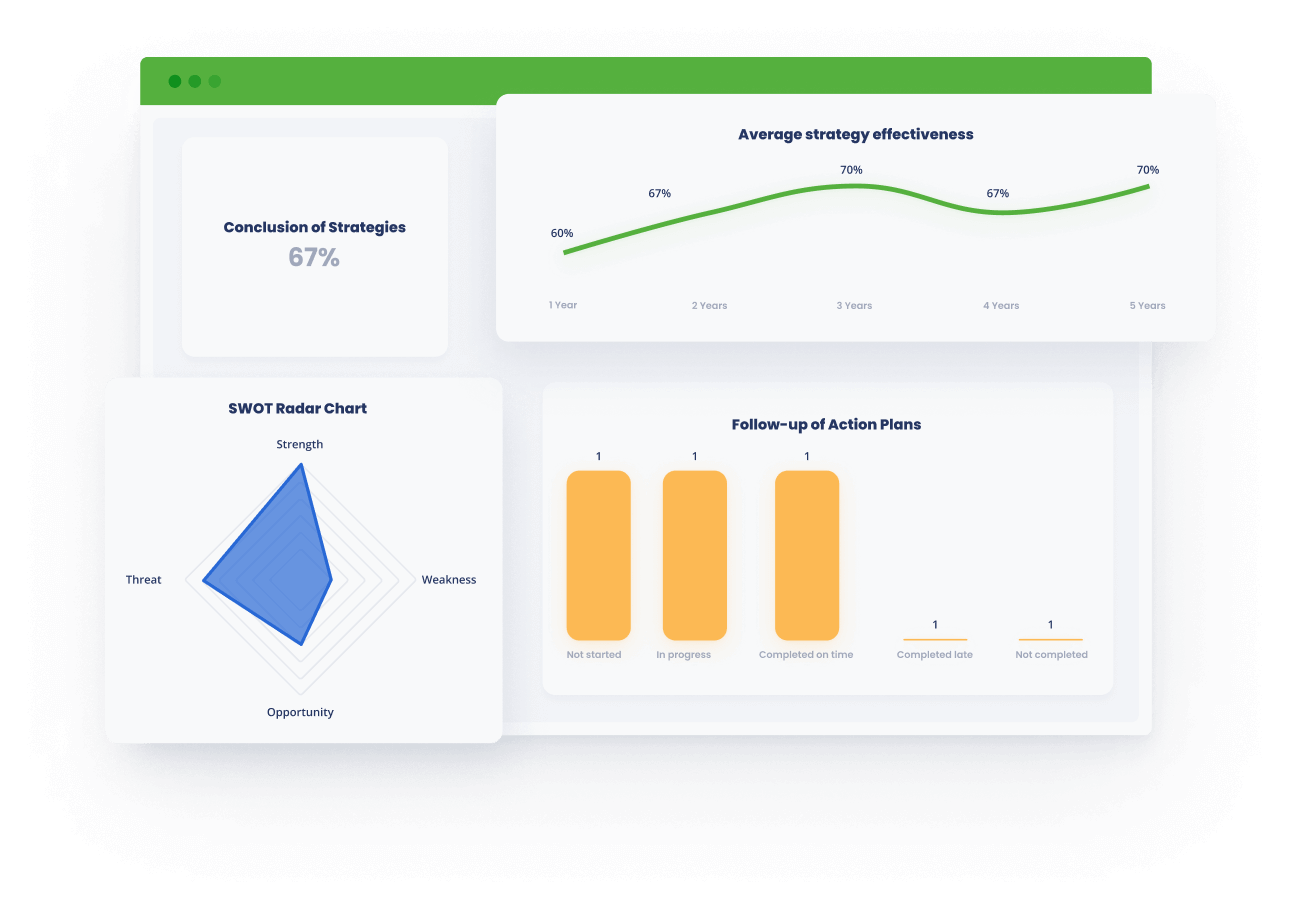

Strategy & Planning

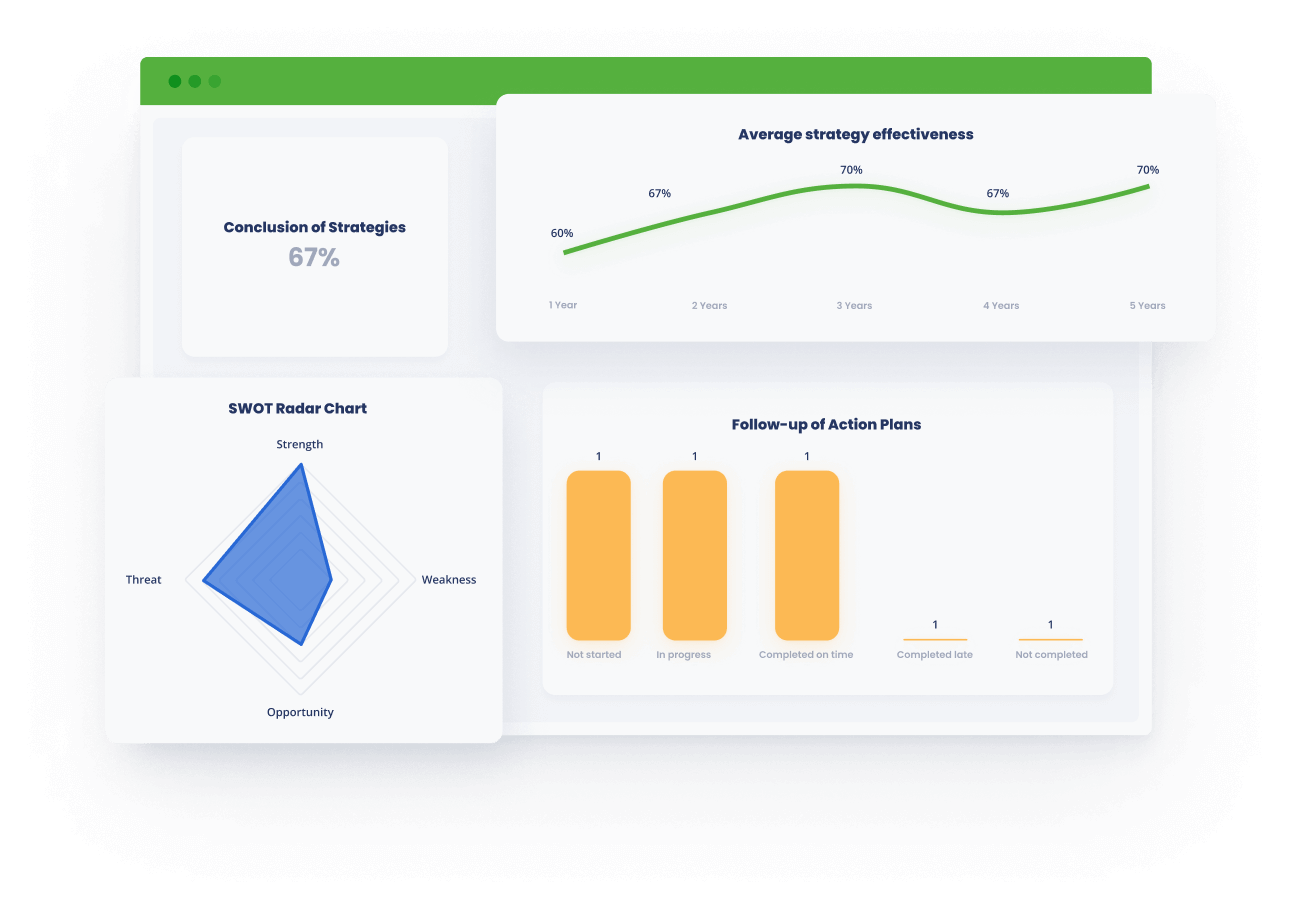

Strategy & Planning

Every business needs to plan for the future and define its strategy using the best available methodologies.

Support

Support

Improve your customer support processes with our ready-to-use templates for this business area

Personal

Optimize, evolve and take control of your life and your family. Manage tasks, groceries, and your finances.

Support

Improve your customer support processes with our ready-to-use templates for this business area

Strategy & Planning

Every business needs to plan for the future and define its strategy using the best available methodologies.

Quality

If you work with quality or process management, our templates will help you implement the main methods of this business area

Project Management

Define scope, tasks, costs, and control project deliverables with the best project management spreadsheets on the market.

Operations & Logistics

Optimize your operations through metrics and performance indicators.

Marketing & Sales

Everything you need to optimize your sales through marketing and planning initiatives or by optimizing your sales funnel and your negotiations.

KPIs & Dashboard

Measure, control, and make better decisions with dashboards.

Human Resources

Manage teams and personnel departments of a company without needing complex systems.

Accounting & Finance

Income, Expenses, and Profitability. Create Cash Flows, Income Statements, and Much More. Complete Financial Management Toolbox!

Our Spreadsheets are used by professionals from the following companies:

Management Methodologies in Micro-Application Format

See some examples below

Implement a 360-degree assessment in your company or customer

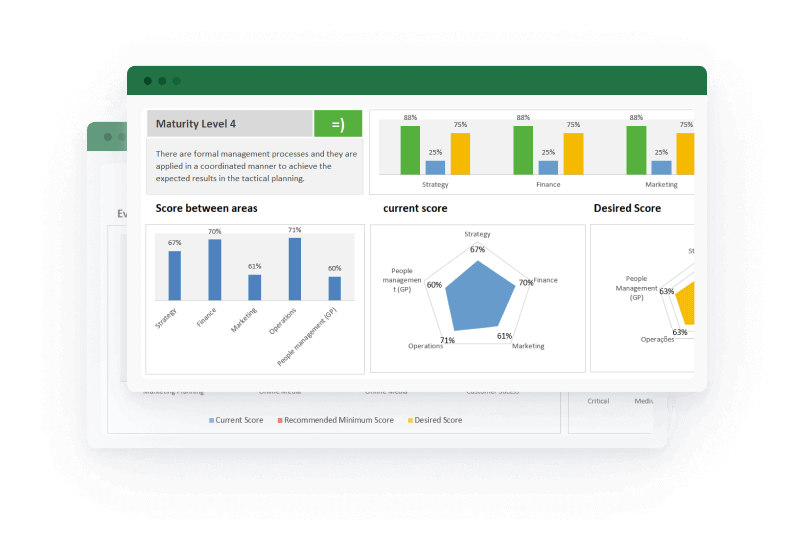

Conduct a business diagnosis to find out where a company needs to improve

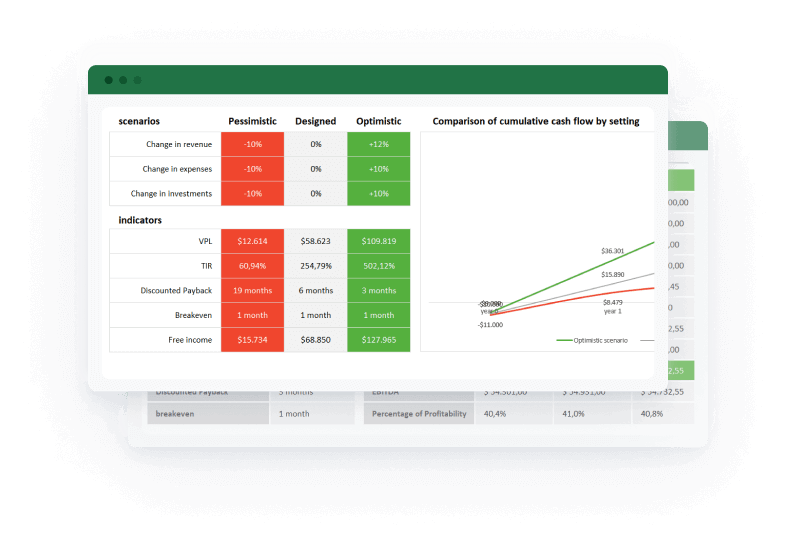

Do an economic feasibility study for a new project

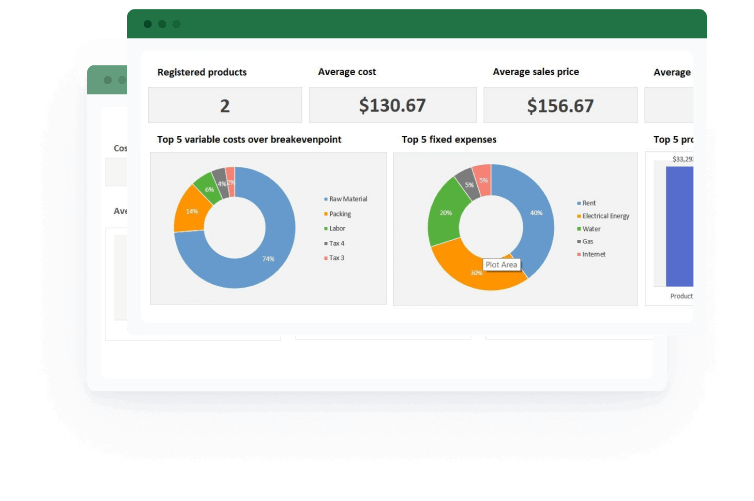

Price services correctly to ensure your profitability

150+ Spreadsheets

See what’s included

and much more!

Powerpoint Templates

But wait, it's not just that...

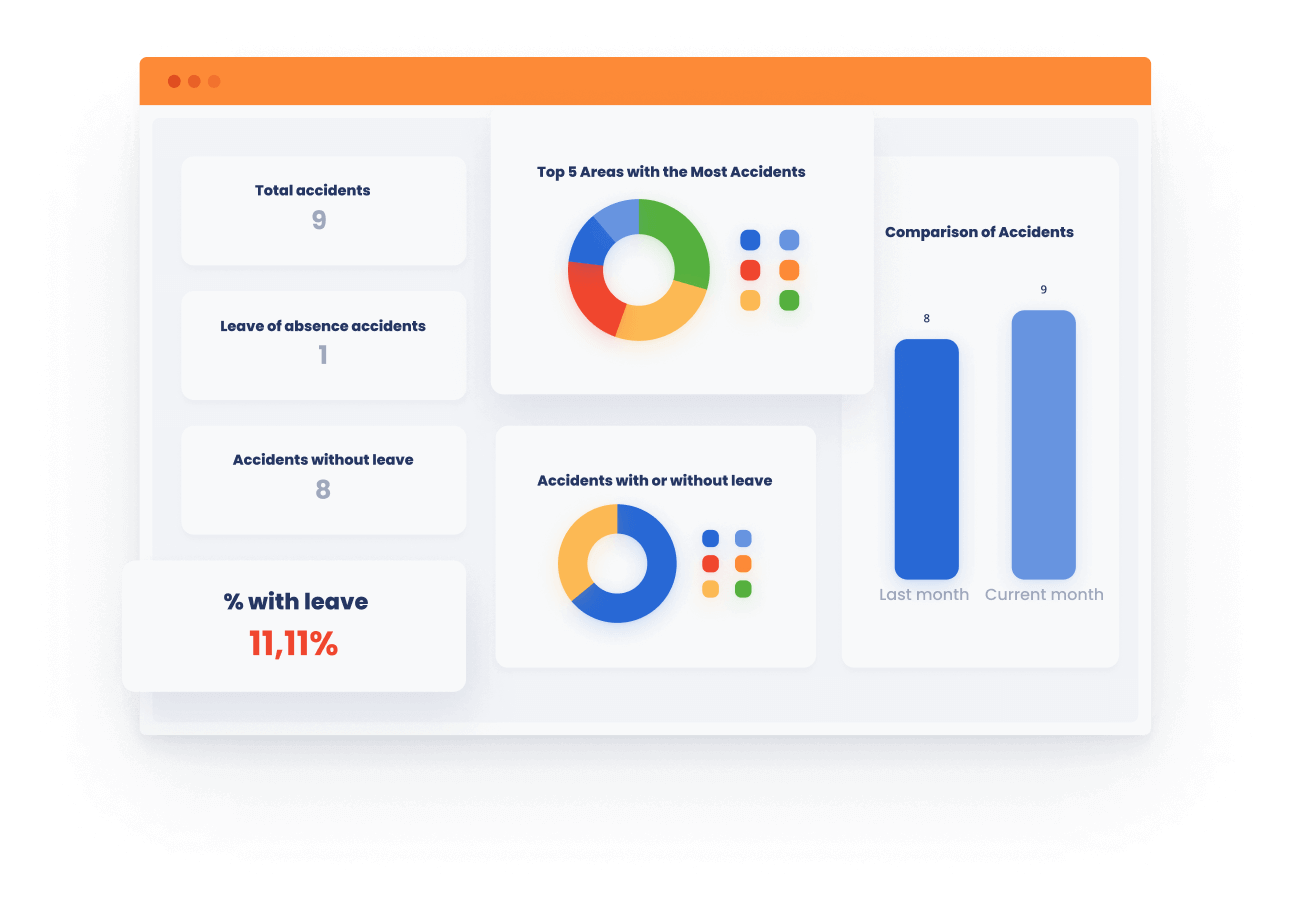

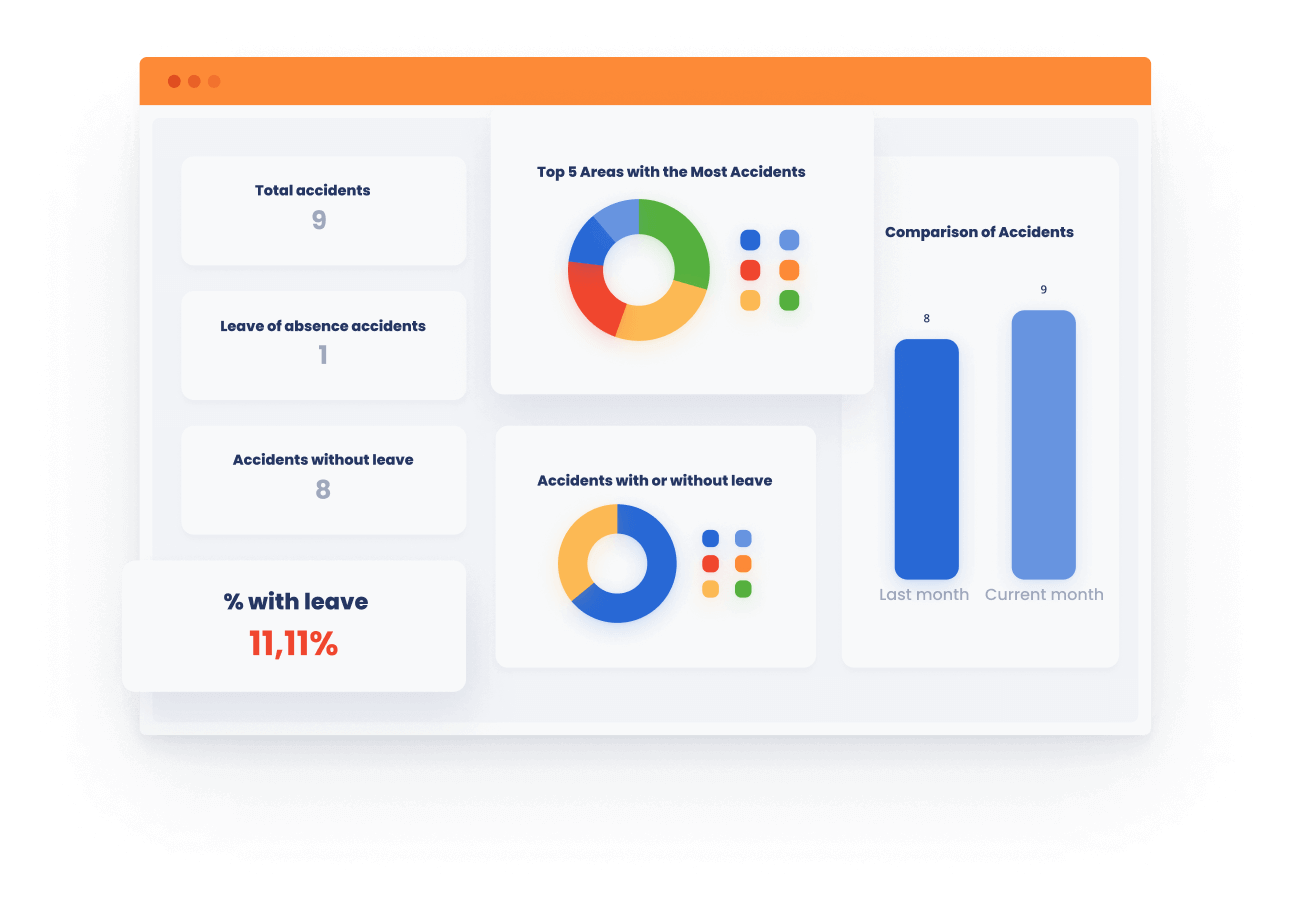

All our spreadsheets have dashboards with performance indicators that help in decision-making.

But presenting a spreadsheet to your team, superiors, or customers is not the best way.

That's why we have presentations ready for that.

What our customers have to say

5/5

Spreadsheets are better than I expected. I highly recommend it to anyone who wants to have financial controls or financial advice.

Jorge Amaral Neto

5/5

The LUZ spreadsheet helped me a lot to organize documents from the company where I work. Revision management and control were very organized. Congratulations to Luz Planilhas Empresariais for the excellent work.

Antonio Guilherme R

5/5

Complete spreadsheet, easy to use and facilitates the audit work. It complies with the requirements of the updated standard.

Didier Correia

5/5

Excellent spreadsheet, it perfectly met the needs of my consultancy.

Fernando Dantas

5/5

Great spreadsheet, it met my expectations, I recommend it!

Timoteo F.

5/5

Wonderful tool, complete, strategic planning with it is very practical.

Maiele Dafine

Subscription Plans

Expert Consultant Plan

- Access to 5 spreadsheets

- Access to all presentations available (+80)

- Free updates

- Use in up to 10 computers

- Premium support

USD 97

annually

Consulting Enterprise Plan

- Access to all spreadsheets available (+120)

- Access to all presentations available (+80)

- Free updates

- Use in up to 10 computers

- Premium support

USD 297

one-time payment